FHLBank Indianapolis, MSHDA announce mortgage program for low-income, first-time homebuyers

last updated on Tuesday, October 22, 2024 in Affordable Housing

In an effort to make homeownership more accessible and affordable in Michigan, the Federal Home Loan Bank of Indianapolis and the Michigan State Housing Development Authority (MSHDA) have created the MSHDA Rate Relief Mortgage Program to benefit low-income, first-time homebuyers in the state.

The new program will allow qualified low-income first-time homebuyers to reduce the cost of their mortgage by one full percentage point if they finance through a MSHDA-approved lender that also is a Bank member. This will allow hundreds of Michigan’s first-time homebuyers to save money every month on their mortgage.

FHLBank Indianapolis is supporting the program by purchasing a $50 million MSHDA bond (Series F), allowing Bank members the opportunity to sell single-family mortgage loans to MSHDA at below-market rates.

.jpg) “Everyone should have the opportunity to own a home,” Cindy Konich (right), President and CEO of FHLBank Indianapolis, said. “That’s why the MSHDA Rate Relief Mortgage Program -- and our growing partnership with MSHDA -- is so important. It reflects our shared vision and values of providing affordable housing solutions, eliminates financing barriers, and opens the door to a brighter future for hundreds of first-time homebuyers in Michigan.”

“Everyone should have the opportunity to own a home,” Cindy Konich (right), President and CEO of FHLBank Indianapolis, said. “That’s why the MSHDA Rate Relief Mortgage Program -- and our growing partnership with MSHDA -- is so important. It reflects our shared vision and values of providing affordable housing solutions, eliminates financing barriers, and opens the door to a brighter future for hundreds of first-time homebuyers in Michigan.”

Key facts about the program:

- Who’s eligible? First-time homebuyers with a qualifying income at or below 80% of Area Median Income (AMI); a credit score of 640 or higher; and must work through an FHLBank Indianapolis member that is also a MSHDA-participating lender.

- Other qualifications: New or existing single-family residences, including some types of manufactured homes; 30-year terms; and a maximum sales price limit of $224,500 (per Michigan law. Other restrictions may apply.)

- Launch date: The program opened Oct. 21, 2024, and will continue until funds are depleted on a first-come, first-served basis.

- How to apply: Interested first-time homebuyers can get more information at their local lending institution. FHLBank Indianapolis members can find more specifics on the Bank’s MemberLink portal and through the Bank’s direct member communications.

Click here to read the joint news release with more details about the program, a list of Bank members that are MSHDA-approved lenders and reaction from Lt. Gov. Garlin Gilchrist II and MSHDA CEO Amy Hovey.

MSHDA also has a dedicated webpage with more basics about the program at Michigan.gov/RateRelief.

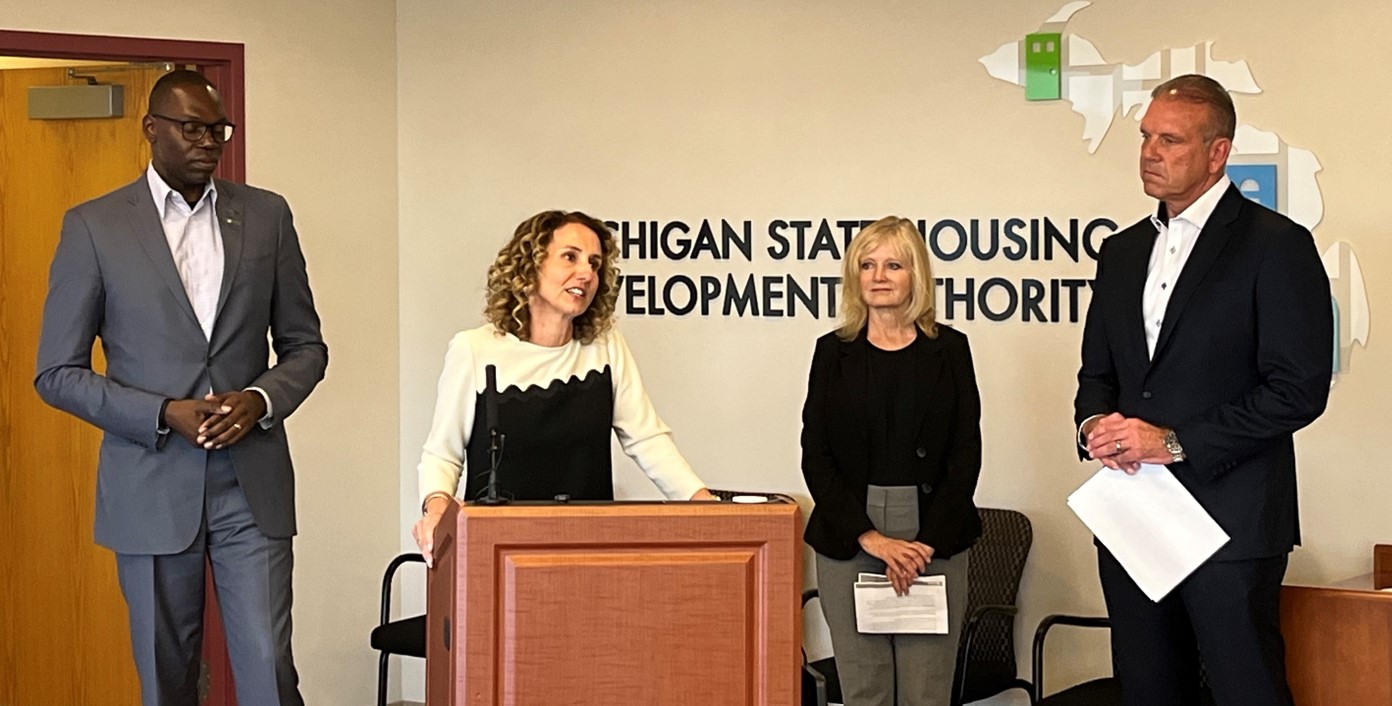

News conference announcement: MSHDA CEO Amy Hovey (at podium) and Cindy Konich, FHLBank Indianapolis President and CEO, jointly announced the MSHDA Rate Relief Mortgage Program during a news conference Tuesday, Oct. 22, 2024, at MSHDA's offices in Lansing, Mich. Michigan Lt. Gov. Garlin Gilchrist II (left) and Dart Bank CEO Bill Hufnagel (right) also attended.

Story by Scott Thien, Sr. Communications Lead. For more information, contact the Corporate Communications department at corpcomm@fhlbi.com.